Tech Valuations Are Shaping Up

Whether you are looking to exit your business or prepare for an eventual sale, the valuation process is a key aspect for all stakeholders involved. Tech Valuations are particularly complex due to the unique nature of technology-based businesses, and there are a range of factors that influence their worth, including the maturity of a given market and the ability of your company to capitalize on future trends.

A successful business sale requires a well-thought-out plan that strategically addresses historical and projected financial performance, intellectual property, team expertise, growth potential, customer relationships and risk mitigation. This approach will ultimately help to ensure that your company achieves an optimal valuation for its final chapter.

One of the first things a prospective buyer will look at is your company’s financial performance, so it is essential that you are able to provide them with a clear picture of your historical revenue and profitability. It’s also important to be able to demonstrate the growth opportunities that lie ahead, supported by market trends and demand, which will help to boost your overall value.

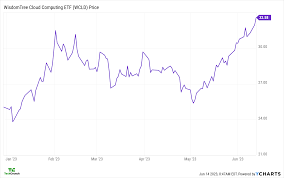

How Tech Valuations Are Shaping Up

In the case of Tech Valuations companies, you can often make a strong case for a higher valuation by showing that your products and services are unique and differentiated from those of your competitors. Demonstrating that you have a good track record of customer retention, as well as providing evidence such as testimonials and case studies, will prove to be highly persuasive in this regard.

If your business is mature and has a strong history of predictably profitable earnings, you can use methods such as discounted cash flow (DCF) to determine the worth of your company. However, this is not always appropriate for technology companies, and more typically, multiples of revenue and EBITDA will be used in their assessment. EBITDA is Earnings before Interest, Taxes, Depreciation and Amortization, and it is normalized to remove any non-cash charges that won’t recur after a sale.

Your team will be a critical factor in determining your tech company’s valuation, and it is vital that you can provide a clear picture of their skills and experience, as well as demonstrating how their knowledge and expertise will add value to a potential buyer. Showing that you have a robust pipeline of new product development will also play a positive role in boosting your overall value.

Finally, a solid and established client base will be another significant contributor to your tech company’s valuation. Proving that you have a loyal customer base will go a long way in convincing a prospective buyer that your business will continue to thrive under their ownership, and this will result in a higher overall value.

Valuing a technology company isn’t an exact science, but the key is to take the time to carefully consider your unique circumstances and the various factors at play. For this reason, it’s worth obtaining expert advice before embarking on the valuation process. Contact us to discuss your specific requirements and find out how we can support you in reaching your objectives.